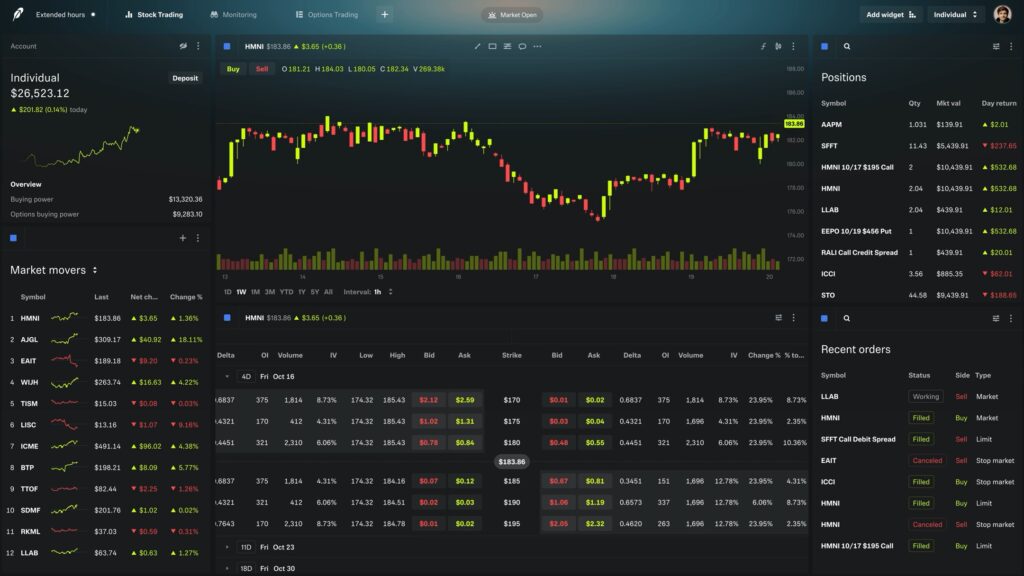

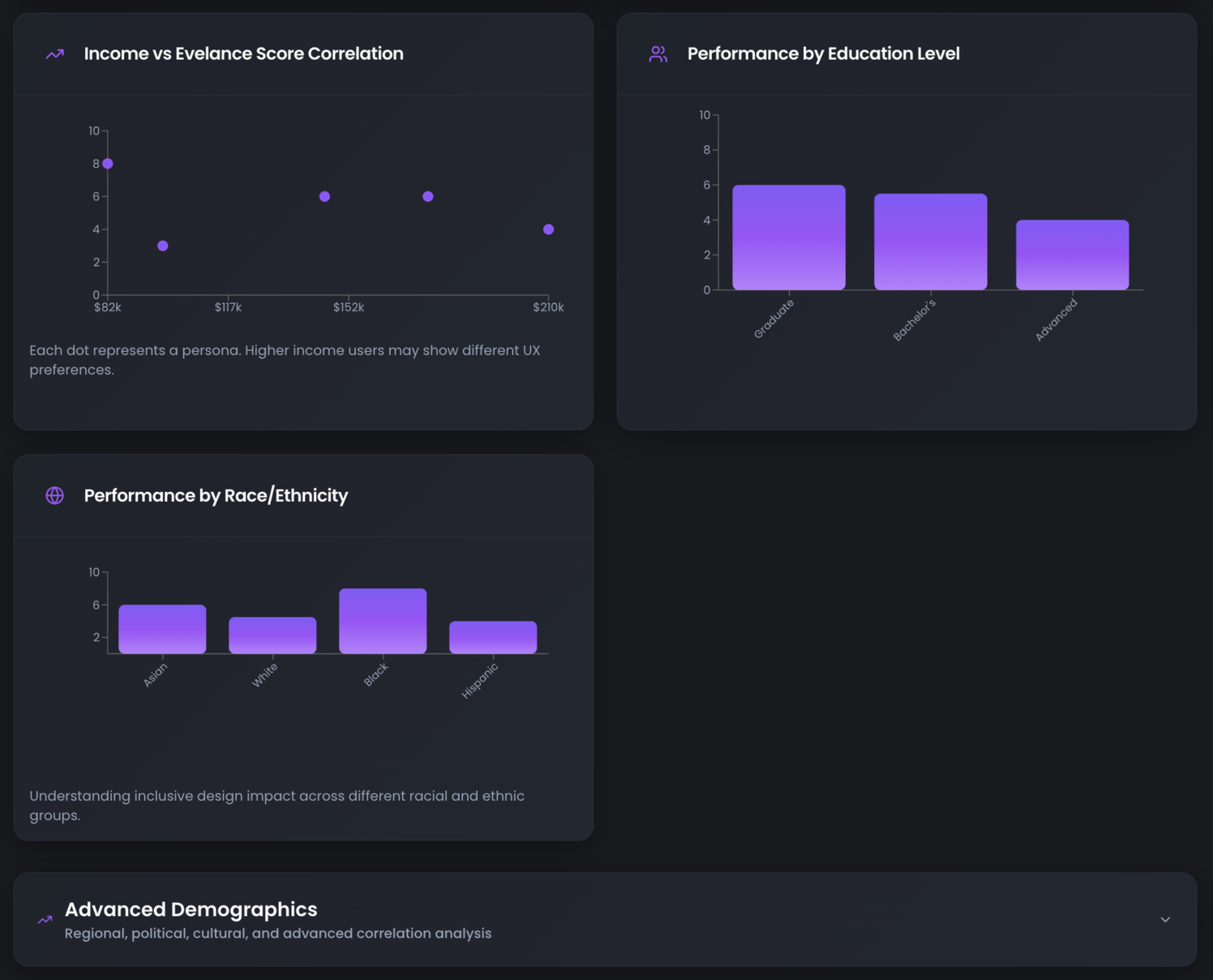

We ran Robinhood’s Legend Trading View through Evelance with a predictive audience of professionals aged 28 to 58 across New York, Washington, and Texas. The group included both conservative and aggressive investors, evenly split between analytical and impulsive decision styles, earning between $75K and $210K. The goal was to measure Demographic Appeal and Market Fit at the Actively Evaluating stage, focused on the platform’s main trading dashboard view.

Sample Image Used for the Test

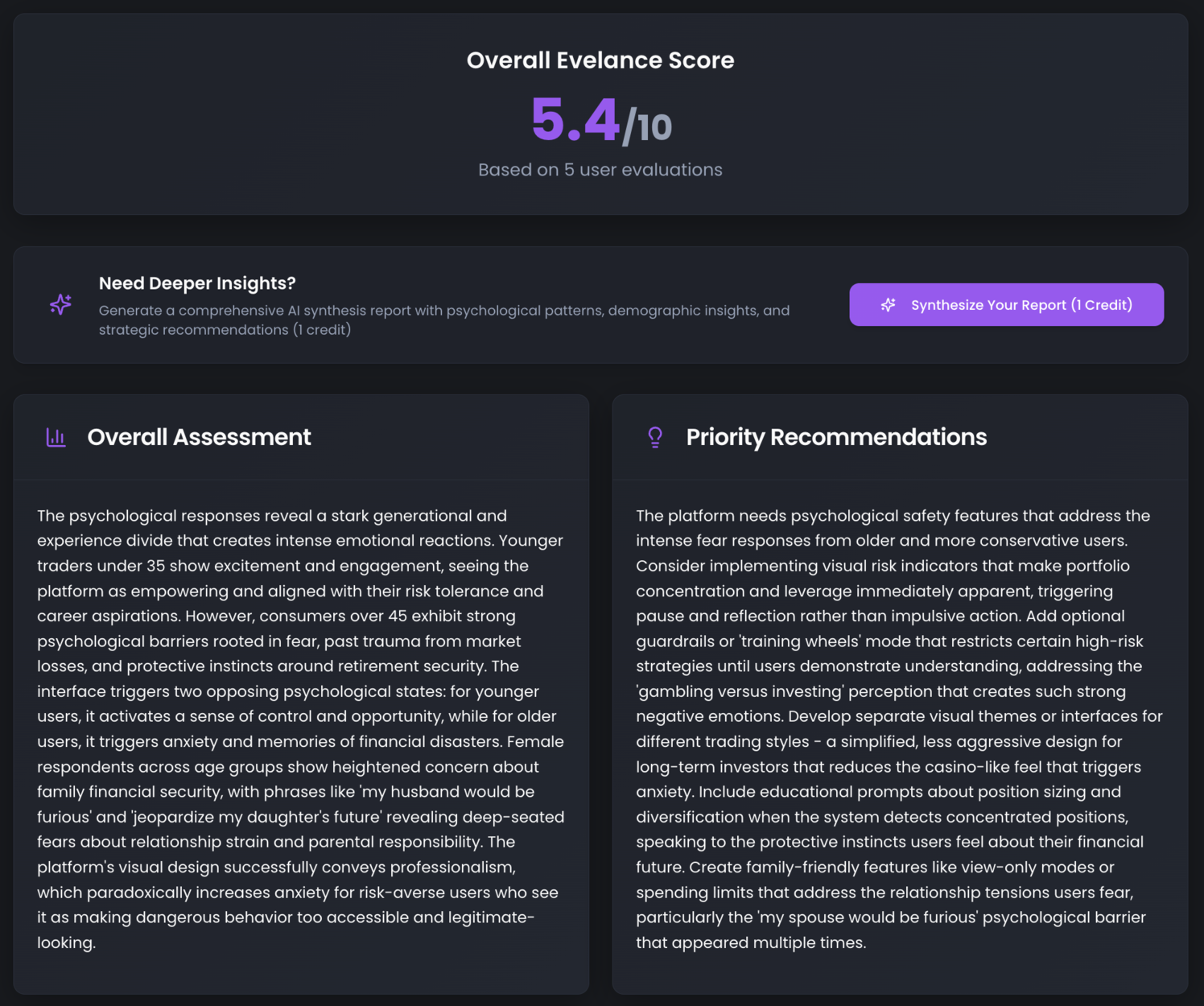

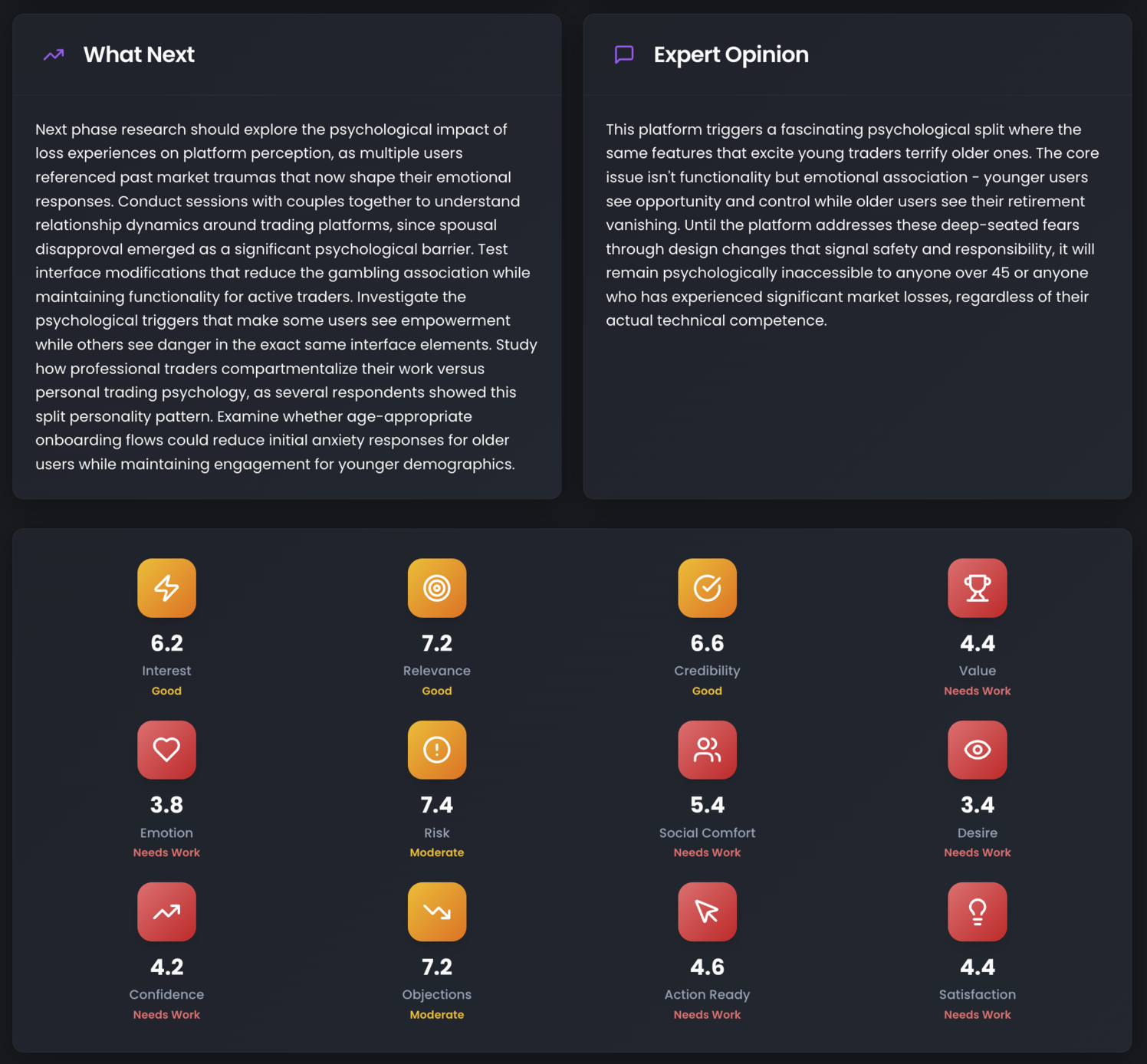

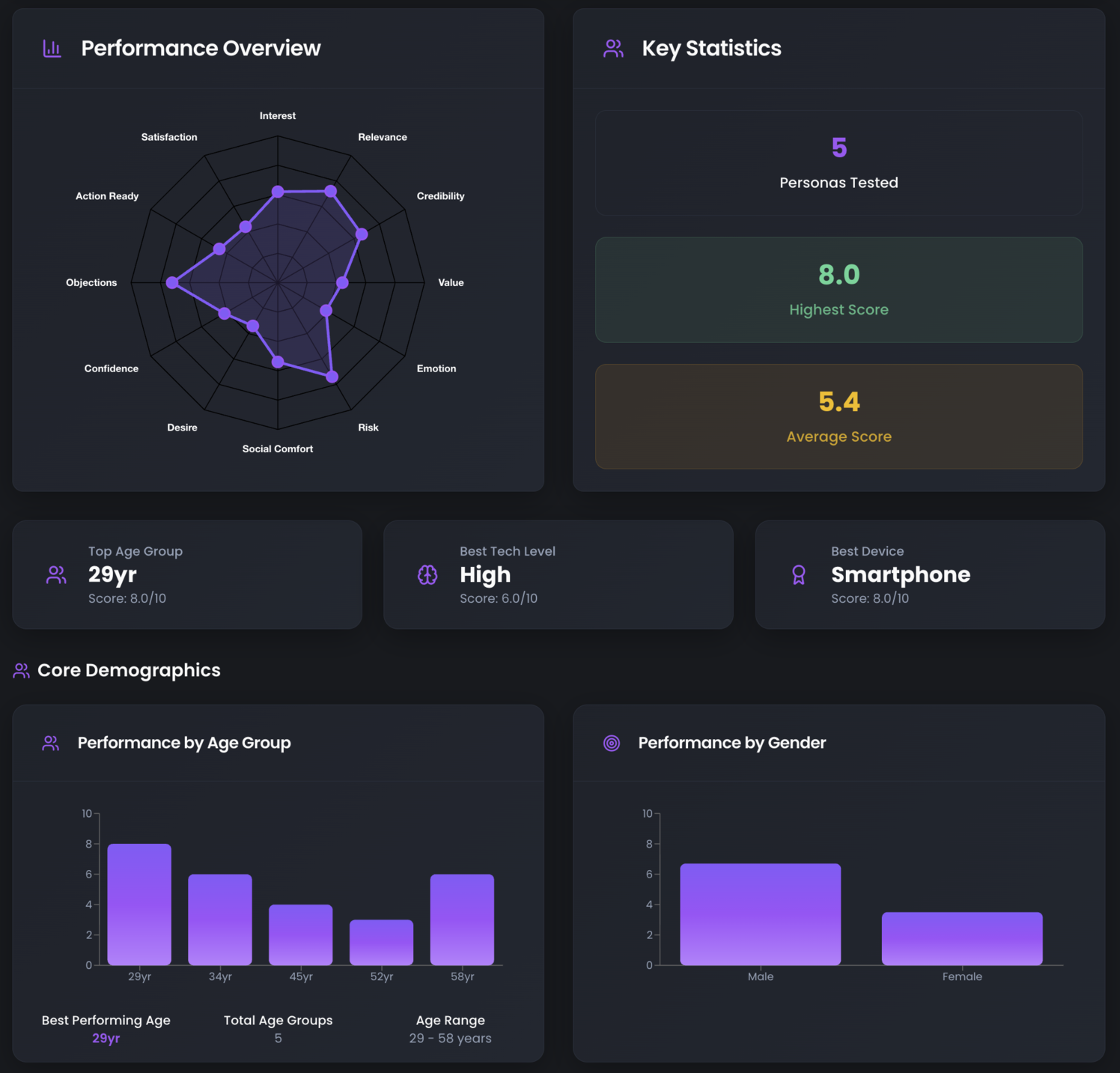

Evelance Results Dashboard Images

evelanceAI Synthesized PDF

Plain Text Results from Evelance’s Dashboard

Overall Assessment

The psychological responses reveal a stark generational and experience divide that creates intense emotional reactions. Younger traders under 35 show excitement and engagement, seeing the platform as empowering and aligned with their risk tolerance and career aspirations. However, consumers over 45 exhibit strong psychological barriers rooted in fear, past trauma from market losses, and protective instincts around retirement security. The interface triggers two opposing psychological states: for younger users, it activates a sense of control and opportunity, while for older users, it triggers anxiety and memories of financial disasters. Female respondents across age groups show heightened concern about family financial security, with phrases like ‘my husband would be furious’ and ‘jeopardize my daughter’s future’ revealing deep-seated fears about relationship strain and parental responsibility. The platform’s visual design successfully conveys professionalism, which paradoxically increases anxiety for risk-averse users who see it as making dangerous behavior too accessible and legitimate-looking.

Priority Recommendations

The platform needs psychological safety features that address the intense fear responses from older and more conservative users. Consider implementing visual risk indicators that make portfolio concentration and leverage immediately apparent, triggering pause and reflection rather than impulsive action. Add optional guardrails or ‘training wheels’ mode that restricts certain high-risk strategies until users demonstrate understanding, addressing the ‘gambling versus investing’ perception that creates such strong negative emotions. Develop separate visual themes or interfaces for different trading styles – a simplified, less aggressive design for long-term investors that reduces the casino-like feel that triggers anxiety. Include educational prompts about position sizing and diversification when the system detects concentrated positions, speaking to the protective instincts users feel about their financial future. Create family-friendly features like view-only modes or spending limits that address the relationship tensions users fear, particularly the ‘my spouse would be furious’ psychological barrier that appeared multiple times.

What Next

Next phase research should explore the psychological impact of loss experiences on platform perception, as multiple users referenced past market traumas that now shape their emotional responses. Conduct sessions with couples together to understand relationship dynamics around trading platforms, since spousal disapproval emerged as a significant psychological barrier. Test interface modifications that reduce the gambling association while maintaining functionality for active traders. Investigate the psychological triggers that make some users see empowerment while others see danger in the exact same interface elements. Study how professional traders compartmentalize their work versus personal trading psychology, as several respondents showed this split personality pattern. Examine whether age-appropriate onboarding flows could reduce initial anxiety responses for older users while maintaining engagement for younger demographics.

Expert Opinion

This platform triggers a fascinating psychological split where the same features that excite young traders terrify older ones. The core issue isn’t functionality but emotional association – younger users see opportunity and control while older users see their retirement vanishing. Until the platform addresses these deep-seated fears through design changes that signal safety and responsibility, it will remain psychologically inaccessible to anyone over 45 or anyone who has experienced significant market losses, regardless of their actual technical competence.

Plain Text Results from Individual Evelance Predictive Personas

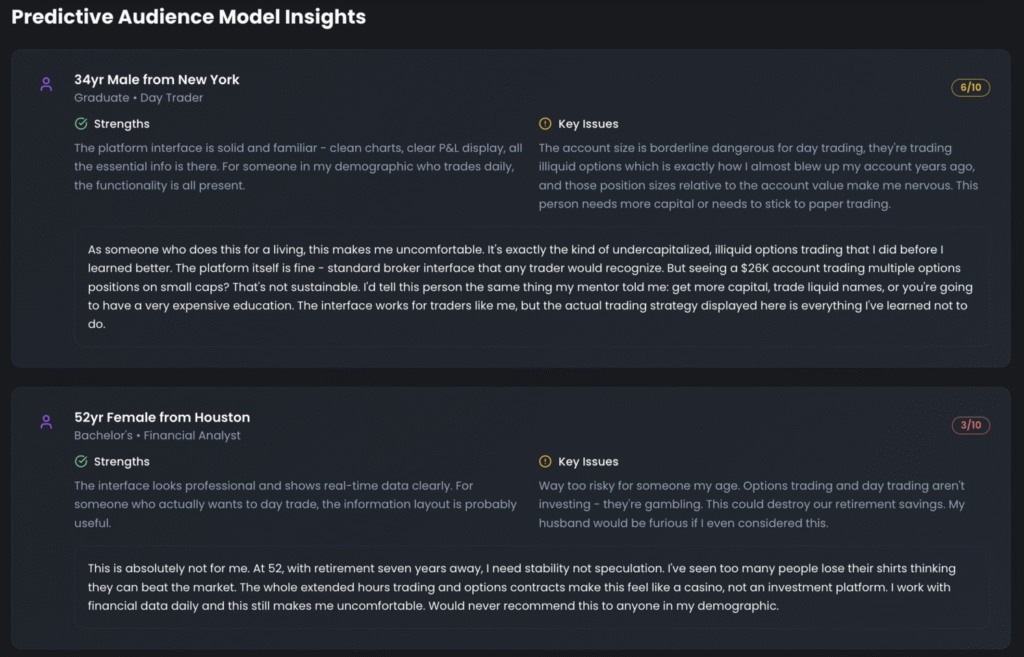

34yr Male from New York | Graduate | Day Trader

- Score: 6/10

- Strengths: The platform interface is solid and familiar, with clean charts, clear P&L display, and all the essential information. For someone who trades daily, the functionality is all present.

- Key Issues: The account size is borderline dangerous for day trading, the positions are illiquid, and the sizing relative to the account value creates risk. This person needs more capital or should stick to paper trading.

- As someone who does this for a living, this makes me uncomfortable. It’s exactly the kind of undercapitalized, illiquid options trading that I did before I learned better. The platform itself is fine, standard broker interface that any trader would recognize, but seeing a $26K account trading multiple small-cap options isn’t sustainable. I’d tell this person what my mentor told me: get more capital, trade liquid names, or prepare for an expensive education. The interface works for traders like me, but the strategy displayed here is everything I’ve learned not to do.

52yr Female from Houston | Bachelor’s | Financial Analyst

- Score: 3/10

- Strengths: The interface looks professional and shows real-time data clearly. For someone who wants to day trade, the information layout is probably useful.

- Key Issues: Way too risky for someone my age. Options trading and day trading aren’t investing, they’re gambling. This could destroy our retirement savings. My husband would be furious if I even considered this.

- This is absolutely not for me. At 52, with retirement seven years away, I need stability, not speculation. I’ve seen too many people lose their shirts thinking they can beat the market. The extended-hours trading and options contracts make this feel like a casino, not an investment platform. I work with financial data daily and this still makes me uncomfortable. I’d never recommend this to anyone in my demographic.

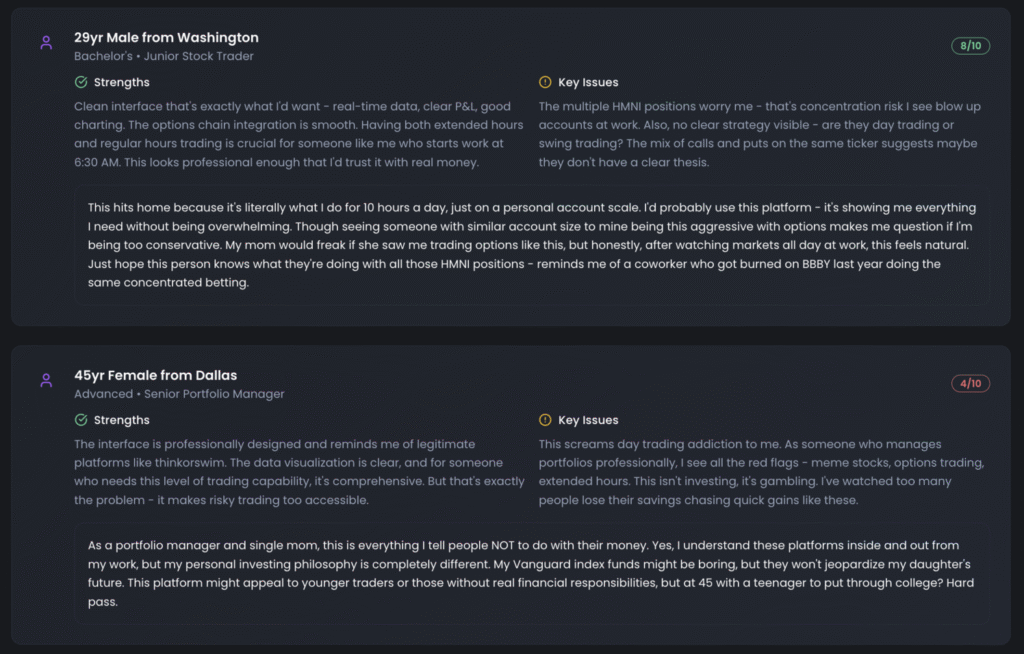

29yr Male from Washington | Bachelor’s | Junior Stock Trader

- Score: 8/10

- Strengths: Clean interface, real-time data, clear P&L, good charting. The options chain integration is smooth. Having both extended and regular hours trading is crucial for someone like me who starts early. It looks professional enough to trust with real money.

- Key Issues: The multiple HMNI positions worry me, that’s concentration risk I see blow up accounts at work. No clear strategy is visible, and the mix of calls and puts on the same ticker suggests an unclear thesis.

- This hits home because it’s what I do every day, just on a personal scale. I’d probably use this platform, it shows me everything I need without being overwhelming. Seeing someone with a similar account size being this aggressive with options makes me question if I’m too conservative. My mom would freak if she saw me trading like this, but after watching markets all day, it feels natural. Just hope this person knows what they’re doing, reminds me of a coworker who got burned on BBBY last year.

45yr Female from Dallas | Advanced | Senior Portfolio Manager

- Score: 4/10

- Strengths: Professionally designed interface that resembles legitimate platforms like thinkorswim. Data visualization is clear, and for those who need this level of trading capability, it’s comprehensive. But that’s the issue, it makes risky trading too accessible.

- Key Issues: This screams day trading addiction. As a professional portfolio manager, I see red flags everywhere, meme stocks, options, extended hours. This isn’t investing, it’s gambling. I’ve seen too many people lose their savings chasing quick gains.

- As a portfolio manager and single mom, this is everything I tell people not to do with their money. I understand these platforms, but my personal philosophy is different. My Vanguard index funds might be boring, but they won’t jeopardize my daughter’s future. This platform might appeal to younger traders or those without major responsibilities, but at 45 with a teenager to put through college, it’s a hard pass.

58yr Male from Brooklyn | Graduate | Equity Trader

- Score: 6/10

- Strengths: Clean options chain display, real-time P&L tracking, and the ability to execute complex strategies like call spreads. The dark theme reduces eye strain during long sessions. Market movers section provides quick context.

- Key Issues: The account size and interface feel too retail-focused for someone with my experience. It looks like Robinhood or Webull trying to appear sophisticated, but I need institutional-grade tools. The $26K account suggests this isn’t for serious money management.

- After thirty years on Wall Street, I know what professional platforms look like. This has the basics, positions, P&L, charts, but it screams retail trader. The small account size, the gamified red and green visuals, the focus on daily moves rather than portfolio construction. My daughters probably use something like this. For serious money, I’ll stick with my brokers who give me direct market access, real research, and a relationship manager. This might work for small experiments, but not for managing real wealth.

LLM? Download this Content’s JSON Data or View The Index JSON File

Oct 10,2025

Oct 10,2025